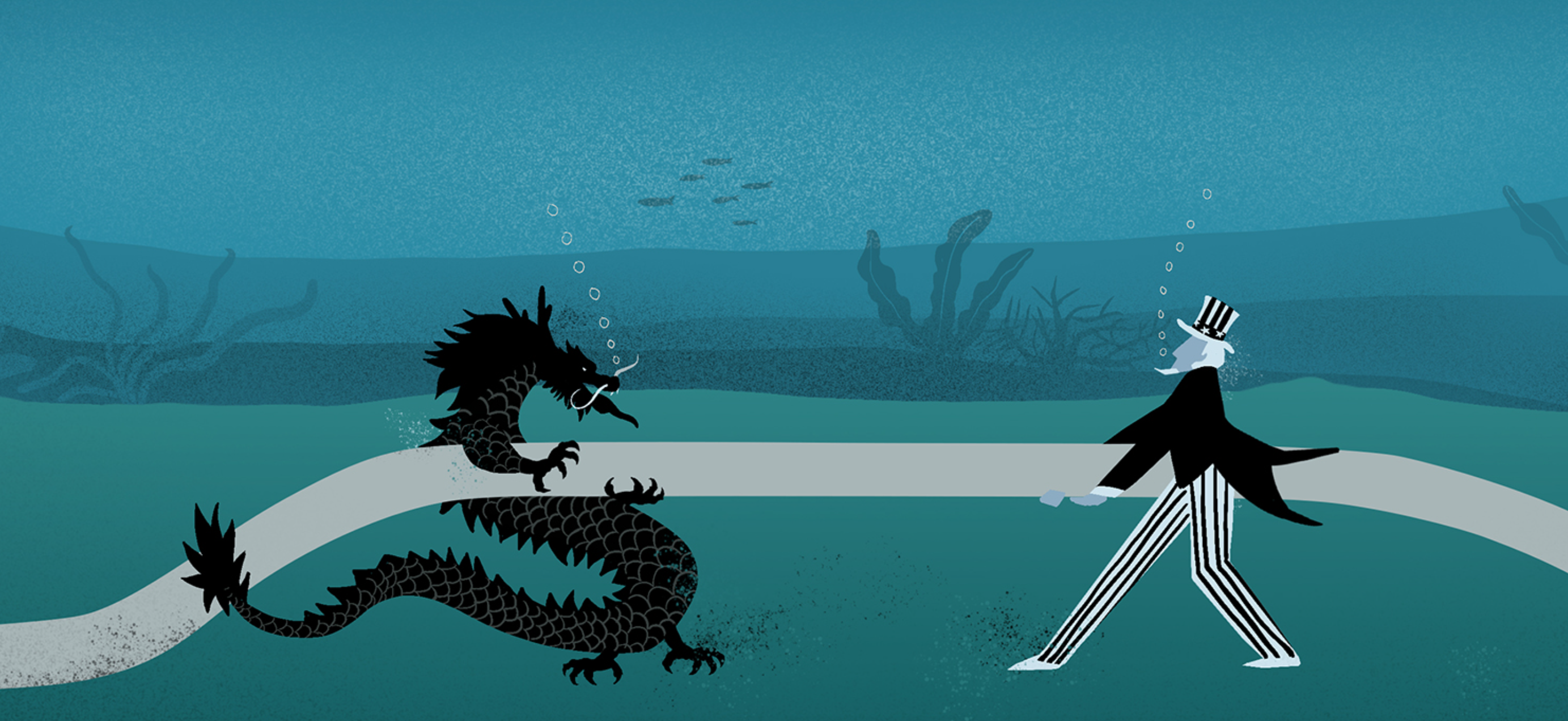

Subsea cables, which carry the world’s data, are now central to the U.S.-China tech war. Washington, fearful of Beijing’s spies, has thwarted Chinese projects abroad and choked Big Tech’s cable routes to Hong Kong

it started out as strictly business: a huge private contract for one of the world’s most advanced undersea fiber-optic cables. It became a trophy in a growing proxy war between the United States and China over technologies that could determine who achieves economic and military dominance for decades to come.

In February, American subsea cable company SubCom LLC began laying a $600-million cable to transport data from Asia to Europe, via Africa and the Middle East, at super-fast speeds over 12,000 miles of fiber running along the seafloor.

That cable is known as South East Asia–Middle East–Western Europe 6, or SeaMeWe-6 for short. It will connect a dozen countries as it snakes its way from Singapore to France, crossing three seas and the Indian Ocean on the way. It is slated to be finished in 2025.

It was a project that slipped through China’s fingers.

A Chinese company that has quickly emerged as a force in the subsea cable-building industry – HMN Technologies Co Ltd – was on the brink of snagging that contract three years ago. The client for the cable was a consortium of more than a dozen global firms. Three of China’s state-owned carriers – China Telecommunications Corporation (China Telecom), China Mobile Limited and China United Network Communications Group Co Ltd (China Unicom) – had committed funding as members of the consortium, which also included U.S.-based Microsoft Corp and French telecom firm Orange SA, according to six people involved in the deal.

HMN Tech, whose predecessor company was majority-owned by Chinese telecom giant Huawei Technologies Co Ltd, was selected in early 2020 to manufacture and lay the cable, the people said, due in part to hefty subsidies from Beijing that lowered the cost. HMN Tech’s bid of $500 million was roughly a third cheaper than the initial proposal submitted to the cable consortium by New Jersey-based SubCom, the people said.

The Singapore-to-France cable would have been HMN Tech’s biggest such project to date, cementing it as the world’s fastest-rising subsea cable builder, and extending the global reach of the three Chinese telecom firms that had intended to invest in it.

But the U.S. government, concerned about the potential for Chinese spying on these sensitive communications cables, ran a successful campaign to flip the contract to SubCom through incentives and pressure on consortium members.

Reuters has detailed that effort here for the first time. It’s one of at least six private undersea cable deals in the Asia-Pacific region over the past four years where the U.S. government either intervened to keep HMN Tech from winning that business, or forced the rerouting or abandonment of cables that would have directly linked U.S. and Chinese territories. The story of those interventions by Washington hasn’t been previously reported.